Uber, Airbnb and the growing divide between capital and labour

Data on the sharing economy and income is hard to come by, so new research from JP Morgan Chase's thinktank, based on scrutinising 260,000 US bank accounts over three years, is worth a look.

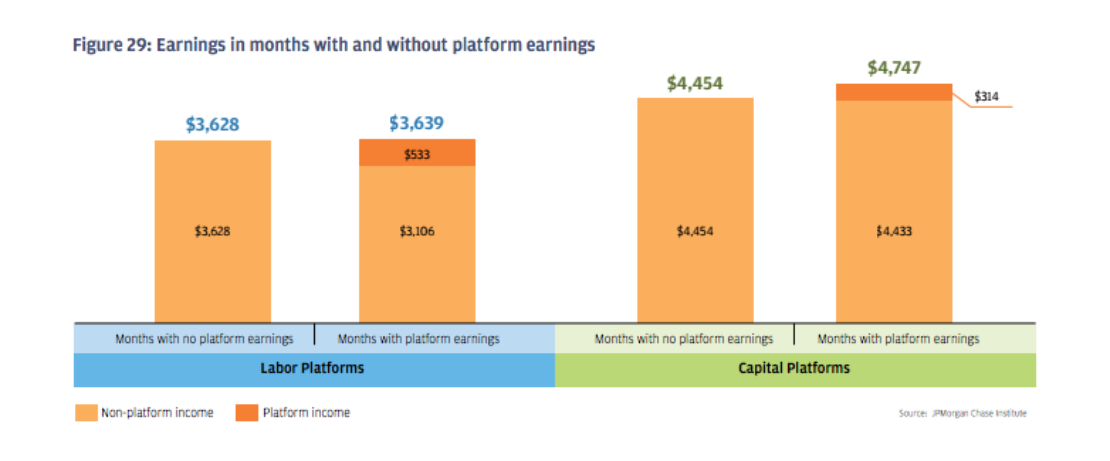

The researchers carved up the 'online platform economy' into labour platforms – those connecting customers with freelance workers who perform tasks, like Uber and TaskRabbit – and capital platforms, which connect customers with individuals who rent assets or sell goods, like Airbnb and eBay. It found that capital platforms are on the whole supplementing people's income, and that these people are generally better off, while labour platforms are only offsetting shortfalls in income month-to-month:

In short, the research suggests, perhaps unsurprisingly, that those who have more capital have the advantage in the sharing economy – helping those with assets to share earn a bit more. This may fuel critics who worry that sharing economy businesses only worsen inequality. The authors conclude that the findings "underscore the importance of asset building".

Favourited

Favourited: Bald Norwegians, French intellectuals and VR flirting Favourited: Electronic music – a blueprintEither way the study shows that both types of business model can help – and do help – people weather income volatility, which is how those platforms like to sell themselves.

Other findings include a trend for labour platforms to be growing more rapidly than capital platforms, while overall many more people are participating in the latter, which chimes with the casual supplementary-income trend above. But it failed to find out anything either way on the question of whether individuals are deepening their reliance on platform income, by participating more or by earning a greater proportion of their total income from these platforms over time: "We found that neither had occurred".

The full report is here (via Quartz).